Miami has one of the highest concentrations of residential swimming pools in the United States, driven by a tropical climate, year-round warm temperatures, and a housing market where outdoor living is a central feature. Pools are common across many Miami neighborhoods, from inland suburbs to coastal and luxury residential areas.

This page presents local, data-based statistics on residential swimming pools in the Miami metro area. The focus is on measurable factors such as pool ownership rates, average pool sizes, usage throughout the year, construction and maintenance costs, and how pools relate to home values. The information is intended to describe how pools exist and are used locally, without offering recommendations or purchasing guidance.

Miami consistently ranks among the top cities in the United States for residential swimming pool ownership, reflecting a long-established pattern in the local housing market rather than a short-term surge in demand.

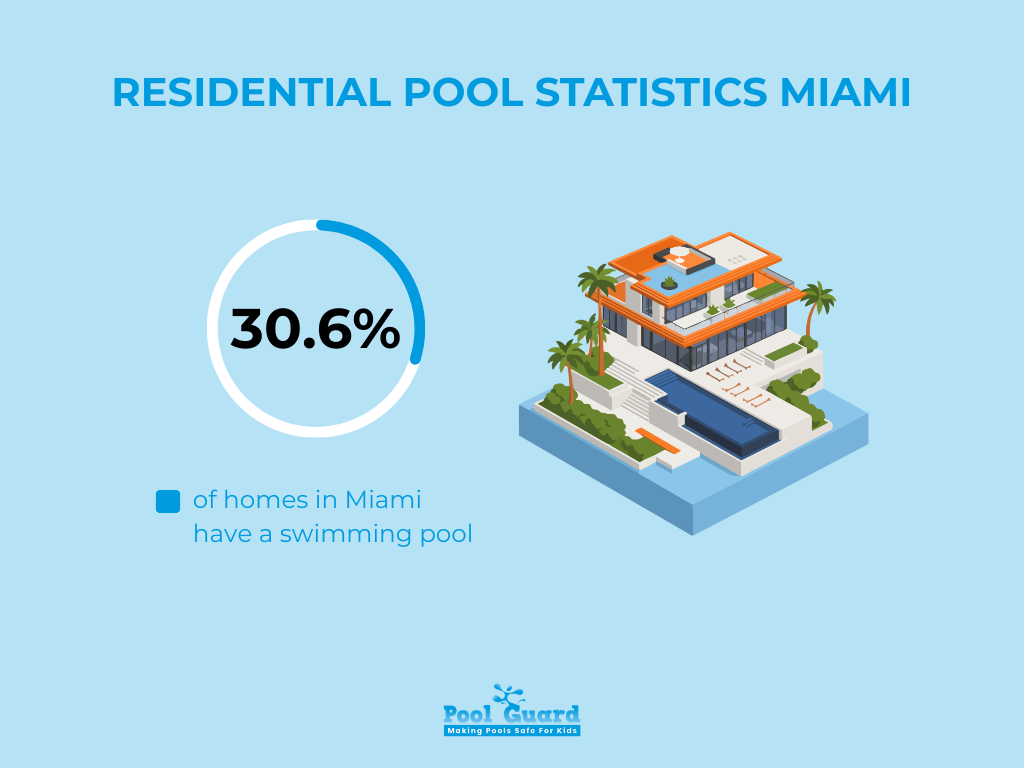

According to national survey data:

In other words, nearly 1 in 3 homes in Miami includes a swimming pool as part of the property’s standard configuration.

This is not seasonal demand. It is not a short-lived trend. It reflects a structural characteristic of Miami’s residential real estate landscape.

Several key factors help explain the sustained strength behind these residential pool statistics for Miami trends and why the city continues to rank so highly on a national level:

In Miami, swimming pools are not positioned as an upgrade or a niche luxury feature. In many neighborhoods and price brackets, they represent a baseline expectation within the residential market — a structural element of property design rather than a discretionary addition.

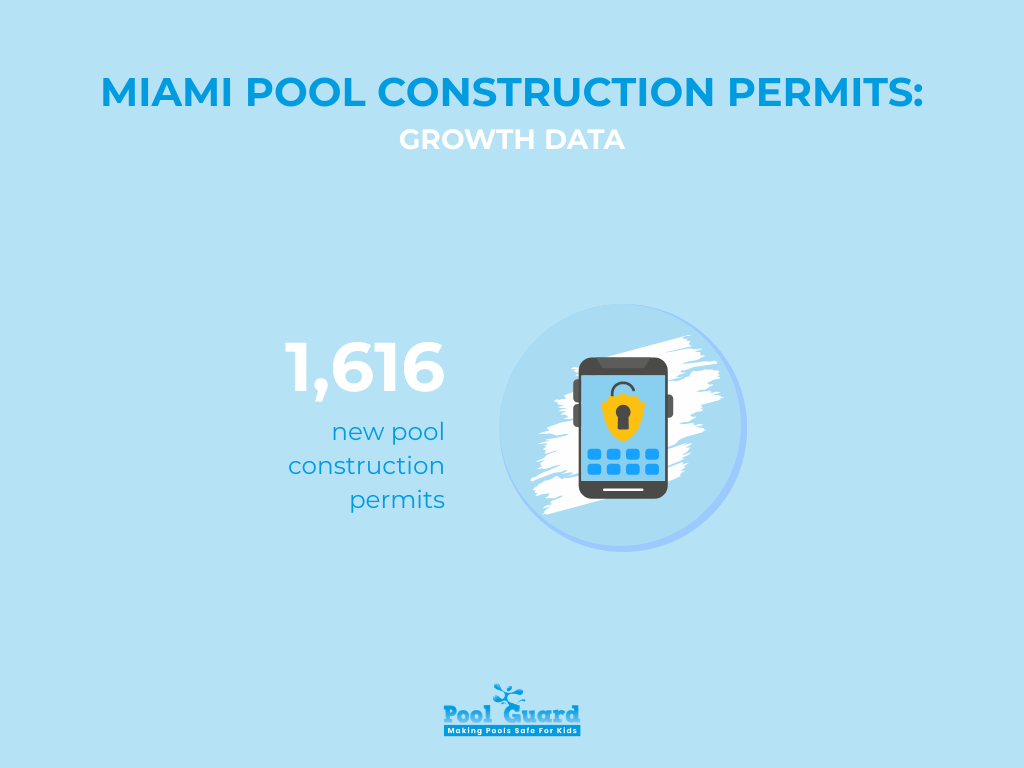

Building permit data provides one of the clearest indicators of real market momentum, offering measurable insight into actual construction activity rather than speculative projections or sentiment-based analysis.

This 36% rebound is not marginal or incremental. It represents one of the strongest county-level growth rates in Florida, suggesting that Miami-Dade’s pool construction sector has regained forward momentum after a two-year contraction phase.

In separate year-to-date data (January–September 2025), Miami-Dade reported approximately:

This performance places Miami among Florida’s most resilient high-end pool construction markets, alongside Palm Beach, Sarasota, Lee, and Collier counties — all of which are known for strong luxury residential activity and consistent outdoor lifestyle demand.

Following the period of pandemic-driven over-expansion and subsequent interest-rate correction, Miami’s residential pool market did not experience structural collapse. Instead, it underwent a recalibration phase, adjusting to new economic conditions before returning to measured growth.

This indicates:

Overall, the data points toward a market that has absorbed volatility, corrected excesses, and re-established growth on more sustainable footing.

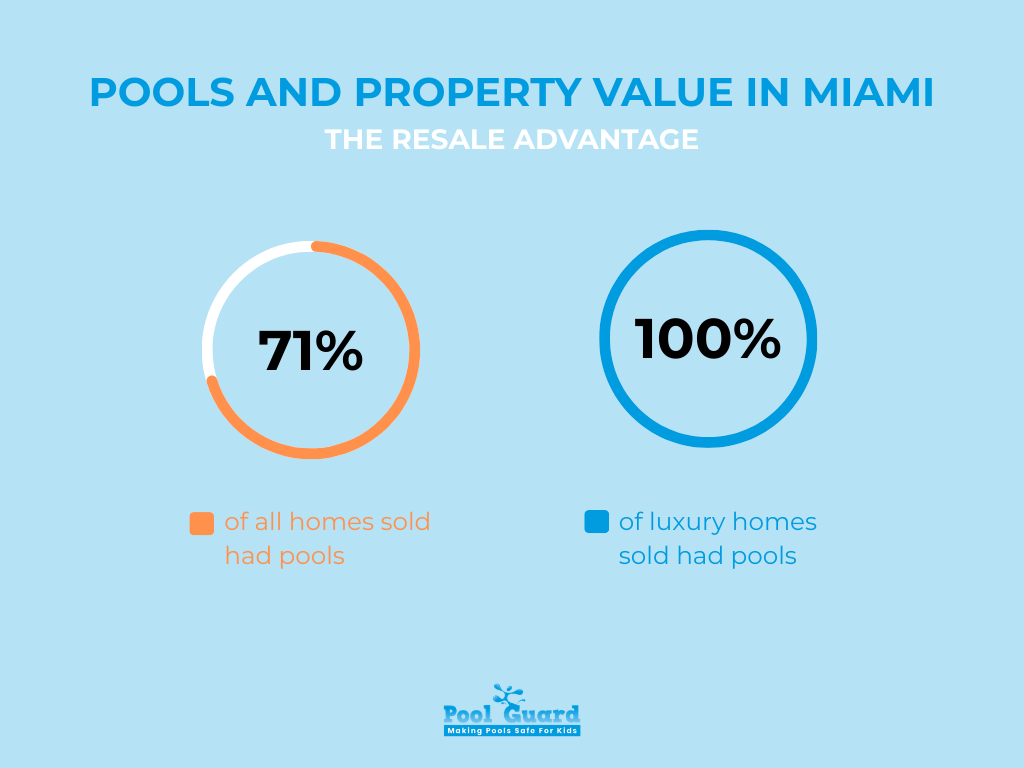

If you’re evaluating residential pool statistics for Miami through the lens of return on investment, the resale data provides some of the most compelling insights. Pool ownership in Miami is not just a lifestyle preference — in many segments of the market, it directly correlates with property value, buyer demand, and competitive positioning.

In high-demand submarkets, buyers increasingly expect pools to include compliant safety barriers, making a properly installed pool fence in Miami an important component of long-term asset protection.

As price increases, pool presence increases dramatically. The data reveals a strong positive correlation between home value and the likelihood that a property includes a swimming pool, particularly in coastal and high-demand submarkets.

If you’re selling high-end real estate in these areas without a pool, you are not simply missing an amenity — you are operating at a structural disadvantage. In competitive luxury segments, buyer expectations are already calibrated toward properties that deliver complete outdoor living experiences, and pool presence plays a central role in that equation.

National Realtor.com analysis (2025) shows:

While the pandemic-driven premium has softened, pools still command a significant pricing advantage.

For Florida specifically:

In Miami’s high-demand submarkets, ROI may exceed that statewide estimate.

Residential pool statistics for Miami don’t exist in isolation.

Miami also leads Florida in commercial pool installations, driven by:

The hospitality sector accounted for a significant portion of pool construction growth in 2024.

Why does this matter for homeowners?

Commercial development normalizes luxury expectations. Buyers begin to expect private pools when surrounded by resort-style living.

Statewide pool permit activity in Florida was down roughly 2.9% year-to-date in 2025.

Miami-Dade, however, posted positive growth.

That divergence signals something critical:

Miami’s pool demand is less cyclical and more lifestyle-driven.

While other counties experienced double-digit declines, Miami’s high-end segment showed resilience and rebound.

Even in a buyer-sensitive market:

Today’s buyer may negotiate price harder than in 2022, but they still prioritize:

The demand has shifted from impulsive to intentional — not disappeared.

Interest rates may moderate. Migration remains strong. Permit growth has stabilized.

That combination suggests:

Measured growth — not frenzy — but sustained demand.

The residential pool statistics for Miami data tells a clear story:

Pools in Miami are not indulgences. They are economic drivers, lifestyle anchors, and competitive assets.

If you operate in Miami real estate, construction, or home improvement, ignoring this data means ignoring market reality.

Explore related safety and pool protection resources at Poolguard USA to ensure your investment is protected long-term.

Please fill out the form below with your information. Your local dealer will be notified about your inquiry.

Please fill out the form below with your information. Your local dealer will be notified about your inquiry.