“How much value does a pool add to a house?” sounds like a simple real estate question. It isn’t.

A swimming pool can boost appeal, hurt resale, inflate liability, or quietly drain tens of thousands of dollars – sometimes all at once. The truth depends on climate, neighborhood norms, buyer psychology, appraisal rules, and how long you plan to own the home.

This guide cuts through marketing fluff, financing spin, and outdated myths. You’ll learn how much a pool really increases home value, when it doesn’t, how appraisers treat pools, and whether a pool helps or hurts when it’s time to sell.

If you want a clear, data-backed answer – this is it.

Let’s start with reality, not wishful thinking.

On average, a swimming pool increases a home’s value by about 1% to 7%, depending on location, climate, and neighborhood expectations. In rare, highly localized markets – such as luxury-heavy areas of Florida, Southern California, or Nevada – the premium can climb into the 10% to 20% range, but these outcomes are the exception, not the rule.

For most homeowners, the more common result is partial cost recovery, not profit. In some cases, especially in cooler climates or price-sensitive markets, a pool can actually reduce buyer demand and lead to lower offers.

This conclusion is consistent across multiple large-scale studies. Research from Zillow, Redfin, and the National Association of Realtors all points to the same reality:

a pool is primarily a lifestyle upgrade, not a dependable financial investment.

To put the numbers in context, Zillow’s analysis found that homes with swimming pools sell for approximately 1.5% more than comparable homes without one. Redfin and Curbio data suggest a slightly higher national return – around 7% – but even that figure rarely offsets the full cost of installation and long-term ownership.

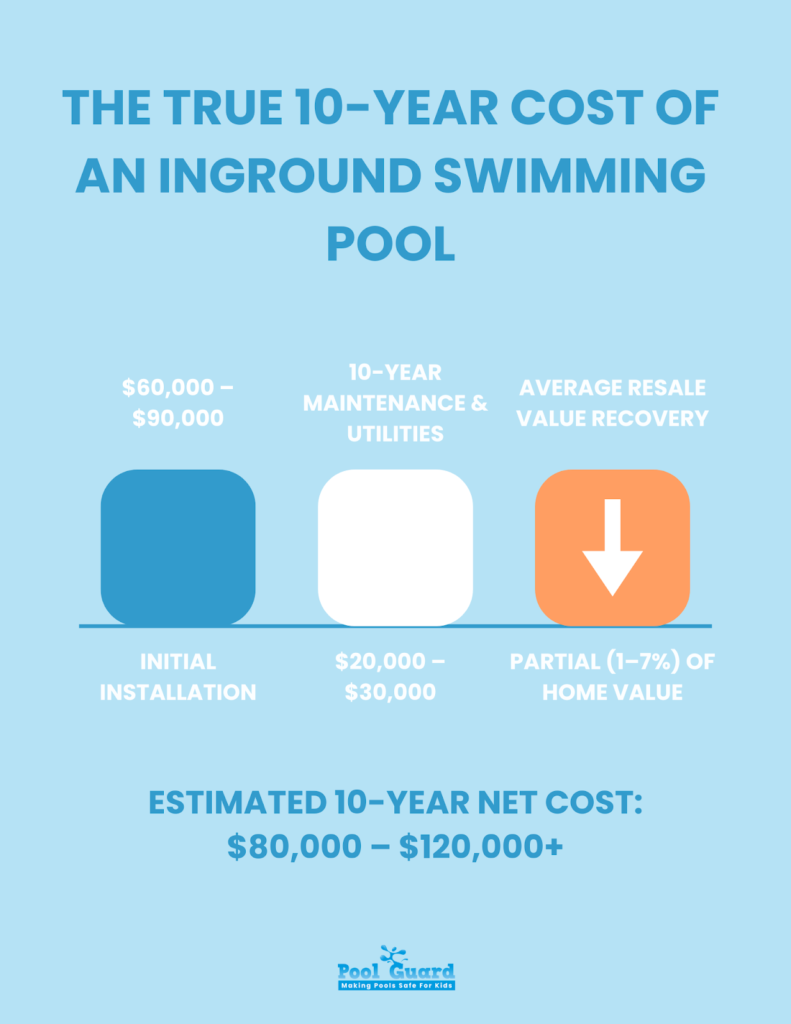

Consider a practical example. A $600,000 home that receives a 5% pool-related price premium gains roughly $30,000 in added value. Yet installing an inground pool often costs $60,000 to $90,000, before factoring in maintenance, utilities, insurance, and repairs. In this scenario, the homeowner experiences a net financial loss, even under relatively favorable conditions.

Key takeaway: When people say a pool “adds value,” they usually mean some appeal, not profit.

Location is the single most important factor in determining whether a pool adds value – or subtracts it.

Swimming pools perform best in regions where they can be used most of the year and where buyers expect them as part of the lifestyle. Pools are often viewed as a desirable amenity rather than a seasonal luxury in warm-climate markets such as:

In these areas, not having a pool can place a home at a competitive disadvantage – especially in higher-end neighborhoods where pools are common among comparable properties. Buyers shopping at certain price points may even assume a pool is included and mentally discount homes that lack one.

That said, even in warm climates, the value increase from a pool is not guaranteed. Premiums vary widely based on neighborhood norms, pool quality, safety features, and buyer preferences. Two similar homes in the same city can see very different outcomes depending on how well the pool aligns with local expectations.

In colder or more seasonal climates, the dynamics shift significantly. In these regions, pools are used for only part of the year, which changes how buyers perceive their value.

Rather than seeing a pool as a benefit, many buyers associate it with:

In states such as Illinois, Oregon, Minnesota, and much of the Northeast, a pool may add little to no value at resale. In some cases, it can even be viewed as a liability – prompting buyers to factor in removal, maintenance, or insurance costs when making an offer.

This leads to a common and important question: is it harder to sell a house with a pool?

In many cold-weather markets, the answer is yes. A pool can narrow buyer interest and extend time on market, particularly when safety features are outdated or the pool shows signs of age.

Yes – by a wide margin.

Inground pools are generally perceived as permanent, integrated features of a property, which makes them far more likely to contribute to home value under the right conditions. When properly designed and well maintained, an inground pool can enhance a home’s appeal and, in some markets, justify a modest price premium. Appraisers are also more inclined to recognize inground pools – at least partially – when comparing similar properties, especially in neighborhoods where pools are common.

Above-ground pools, on the other hand, rarely provide the same benefit. Most buyers view them as temporary additions rather than true home improvements. As a result, above-ground pools typically add little to no resale value and are frequently removed before a home is listed for sale. In some cases, they can even reduce buyer interest by limiting yard space or raising concerns about safety and aesthetics.

If resale value is an important consideration, the distinction is clear: inground pools consistently outperform above-ground pools, while above-ground options are best viewed as short-term lifestyle purchases rather than value-adding features.

This is where many homeowners are shocked.

Appraisers do not credit pools at replacement cost. Instead, they:

How much value does a pool add to an appraisal?

There is no fixed number – but it’s almost always less than what you paid.

Understanding value requires understanding total cost.

Over 10 years, many owners spend $20,000–$30,000+ just maintaining the pool.

Sometimes, yes – and this matters more than people admit.

Many buyers actively avoid homes with pools:

Even in warm climates, a pool can exclude as many buyers as it attracts.

If your buyer isn’t a “pool person,” the feature becomes friction – not a benefit.

Key insight: More interest doesn’t always mean better offers.

A pool is most likely to help (or at least not hurt) when all of the following are true:

Miss one or more of these? The odds tilt against you.

Not all pools are valued equally. Two homes in the same neighborhood can have identical square footage and wildly different outcomes at resale – purely because of pool condition, features, and perceived risk.

Appraisers and buyers don’t ask “Does this house have a pool?”

They ask “What kind of pool is this – and what problems might it bring?”

These features consistently improve buyer confidence and appraisal treatment:

Pool age matters. A pool that’s been resurfaced within the last 5–7 years signals lower near-term repair risk. Older finishes raise concerns about leaks, plaster failure, and costly repairs – often leading to discounted offers.

Modern variable-speed pumps, efficient heaters, and updated filtration systems reduce monthly operating costs. Buyers increasingly factor utility expenses into affordability, making efficiency a tangible value booster.

Safety is one of the most overlooked drivers of value. Homes with compliant fencing, pool alarms, and secure covers reduce perceived liability – especially for families with children or pets. These features don’t just protect lives; they protect resale appeal.

Integrated hardscaping, lighting, and thoughtful landscaping elevate the pool from a “maintenance item” to a lifestyle asset. A visually cohesive outdoor space helps buyers justify a premium.

Pools paired with outdoor kitchens, shaded seating, or entertainment zones perform better than standalone pools. Buyers respond to use cases, not just features.

Smart automation – remote monitoring, automated cleaning, chemical balance alerts – reduces the perceived time burden of ownership. Less hassle equals higher buyer acceptance.

Entities reinforced: pool age, filtration system, safety features, hardscaping, landscaping, smart automation

These issues can neutralize – or even reverse – any value a pool might add:

Aging pumps, heaters, or filtration systems are red flags. Buyers immediately calculate replacement costs and adjust offers downward.

Structural concerns trigger inspection anxiety. Even cosmetic staining can raise suspicion of deeper issues, hurting negotiations.

Dated tile, obsolete pool shapes, or old coping can make a pool feel like a liability instead of a luxury.

Pools that require constant manual upkeep, frequent service calls, or specialized knowledge turn buyers away – especially first-time pool owners.

Lack of visible safety compliance is a major deterrent. For buyers with children, this can be an immediate deal-breaker.

Pools don’t just affect sale price – they influence ownership costs, which directly shape buyer behavior.

Adding a pool almost always increases homeowners insurance exposure.

Buyers factor these ongoing costs into affordability. A well-secured pool with modern safety systems minimizes insurance friction and protects perceived value.

Entities reinforced: homeowners insurance, liability coverage

In many states, an inground pool can increase a home’s assessed value, leading to higher annual property taxes.

Key points homeowners overlook:

This mismatch – higher taxes without proportional resale gain – can dampen buyer enthusiasm.

Entities reinforced: tax assessment, property value

Local codes typically require:

Homes that meet or exceed safety compliance:

Non-compliance, on the other hand, introduces uncertainty – something buyers and lenders dislike.

Entities reinforced: safety compliance, legal requirements

This is the question many sellers ask – and the one most articles dodge.

Here’s the clear, experience-backed answer.

Adding a pool before selling only makes sense if all of the following are true:

Even then, the goal is usually competitiveness, not profit.

Installing a pool before selling is almost always a mistake when:

In these cases, sellers rarely recover costs – and sometimes reduce their buyer pool.

If a pool already exists, strategic upgrades can pay off:

These improvements reduce buyer objections and inspection friction, often delivering better ROI than installing a brand-new pool.

Above-ground pools are frequently seen as temporary or unattractive.

In many markets:

…results in higher buyer interest and cleaner appraisals than leaving the pool in place.

Entities reinforced: seller strategy, ROI improvement, renovation value, property attractiveness

Adding a pool before selling is rarely about increasing value – it’s about avoiding disadvantage in very specific markets. Most sellers are better served by improving safety, condition, and presentation of an existing pool rather than building a new one.

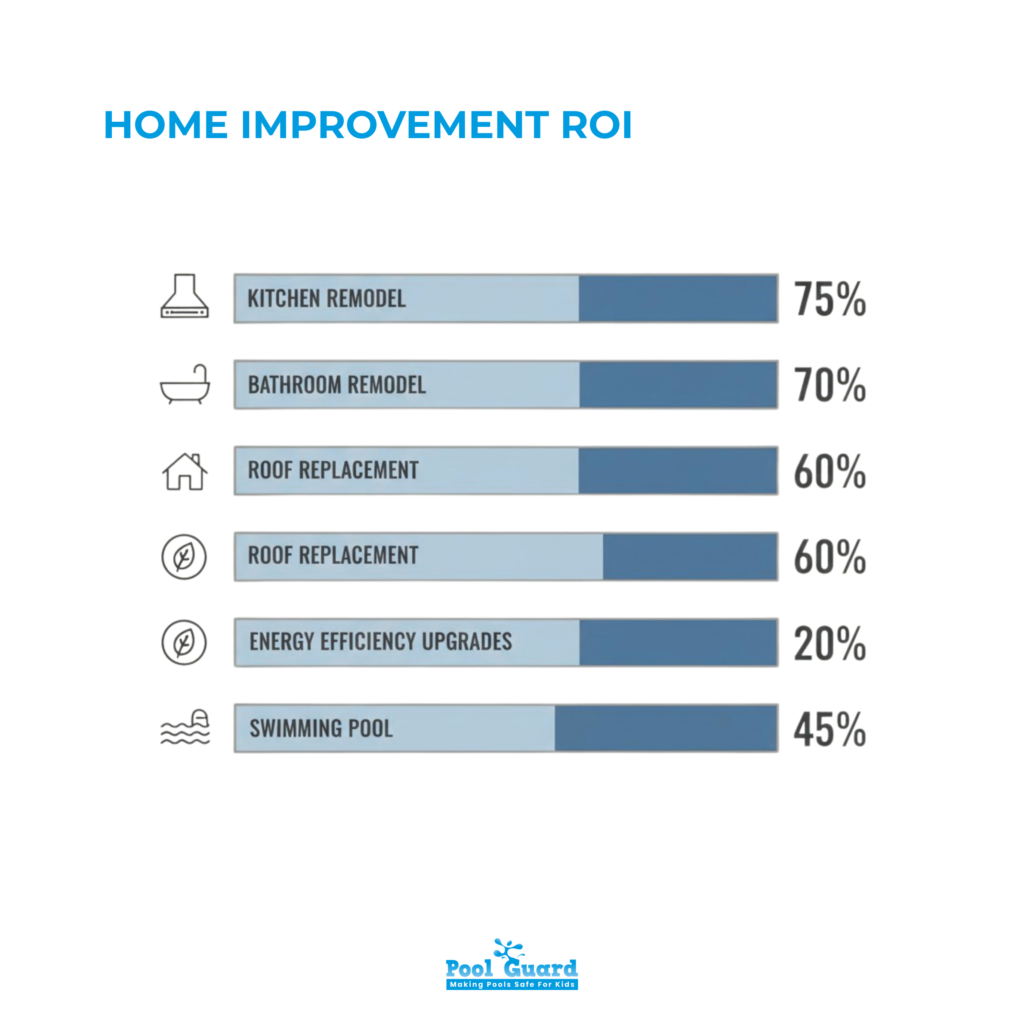

Pools compete with other upgrades for capital.

| Improvement | Typical ROI |

| Minor kitchen remodel | 60%–80% |

| Bathroom remodel | 50%–70% |

| New roof | 60%+ |

| Energy-efficient upgrades | Often positive |

| Swimming pool | 1%–7% (sometimes less) |

From a pure financial standpoint, pools consistently underperform.

Financing doesn’t change ROI – it amplifies losses.

Using:

…turns a depreciating luxury into long-term debt.

This increases:

If you wouldn’t write a cash check for the pool, financing won’t make it a better decision.

Search data shows “homes with pools” are popular – but behavior doesn’t equal economics.

Buyers want:

But when it’s time to write an offer, concerns surface:

This emotional reversal explains why pools are high-interest but low-ROI features.

No – if your primary goal is increasing home value or net worth.

Yes – if you value daily use, privacy, and experience more than the money.

The biggest mistake homeowners make is pretending these two goals are the same.

A pool is not an investment. When people ask how much value does a pool add to a house, the honest answer is that while a pool can increase a home’s price, the increase is usually not enough to cover the cost of building and maintaining it. Inground pools tend to perform better than above-ground pools, but they still underperform many other home upgrades in terms of resale value. Appraisals rarely credit pools dollar for dollar, and in many markets a pool can actually make a home harder to sell by shrinking the buyer pool. Financing a pool only amplifies the downside by adding interest costs to an already weak return. The only scenario where a pool makes sense financially is when you want it for personal use and are willing to accept the cost with the understanding that resale recovery will be partial at best.

If you frame a pool as an investment, you will misjudge the risk and overestimate the return. If you frame it as lifestyle spending with limited resale recovery, you can make a clearer, more honest decision.

If safety, resale confidence, and buyer trust matter to you, explore modern pool protection solutions that reduce liability and improve buyer perception. A safer pool is always more marketable.

Please fill out the form below with your information. Your local dealer will be notified about your inquiry.

Please fill out the form below with your information. Your local dealer will be notified about your inquiry.